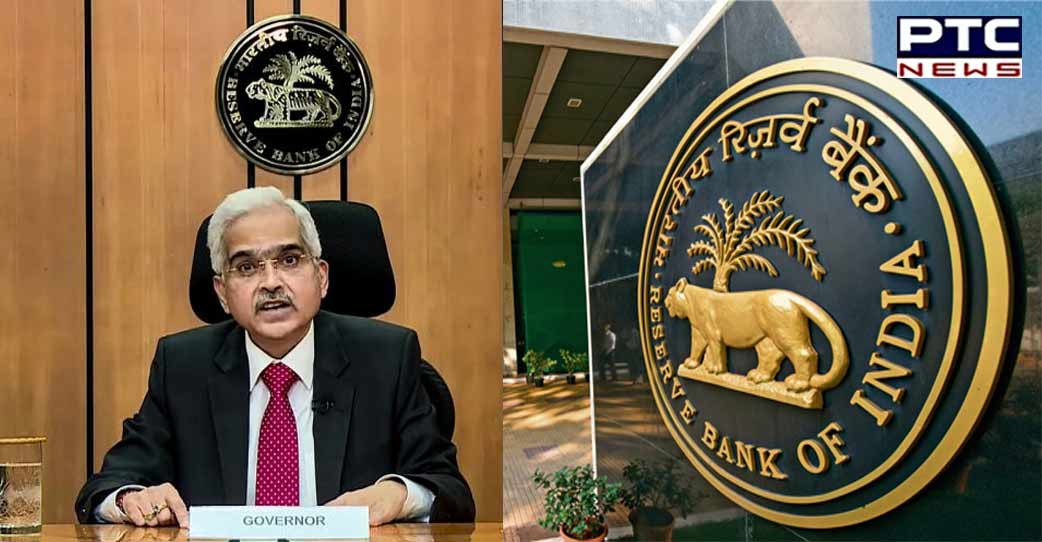

Mumbai, August 10: To tighten the noose on miscreants indulging in online frauds and unlawful activities, the Reserve Bank of India (RBI) on Wednesday released the first set of norms to regulate digital lending.

As per the new norms released by the RBI, all loan disbursals and repayments will have to be executed only between the bank accounts of the borrower and the regulated entity without any pass-through or pool account of the lending service provider (LSP) or any third party.

Also Read | Bihar: Nitish Kumar takes oath as CM for 8th time; Tejashwi Yadav as his deputy

Also Read | Bihar: Nitish Kumar takes oath as CM for 8th time; Tejashwi Yadav as his deputy

Only entities regulated by RBI, other bodies permitted by law can carry out digital lending, added the RBI.

The Reserve Bank's regulatory framework is focused on the digital lending ecosystem of RBI's Regulated Entities (REs) and the Lending Service Providers (LSPs) engaged by them to extend various permissible credit facilitation services.

With regard to entities authorised to carry out lending as per other statutory/regulatory provisions, but not regulated by RBI, the respective regulator/ controlling authority may consider formulating or enacting appropriate rules/regulations on digital lending based on the recommendations of WGDL.

Also Read | HC orders status quo in Mohali panchayat land grabbing case

Also Read | HC orders status quo in Mohali panchayat land grabbing case

For the entities lending outside the purview of any statutory/ regulatory provisions, the WGDL has suggested specific legislative and institutional interventions for consideration by the Centre to curb the illegitimate lending activity being carried out by such entities.

The RBI is statutorily mandated to operate the credit system of the country to its advantage. In this endeavour, it has encouraged innovation in the financial system, products and credit delivery methods while ensuring their orderly growth, preserving financing stability and ensuring protection of depositors' and customers' interest.

Recently, innovative methods of designing and delivery of credit products and their servicing through digital Lending route have acquired prominence. However, certain concerns have also emerged which, if not mitigated, may erode the confidence of members of public in the digital lending ecosystem.

The concerns primarily relate to unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices.

On the data privacy front, the RBI has said the data collected by digital lending apps (DLAs) has to be need based, should have clear audit trails and be only done with prior explicit consent of the borrower. Further, these apps have to provide an option to borrowers to accept or deny consent for use of specific data.

-PTC With ANI inputs

As per the new norms released by the RBI, all loan disbursals and repayments will have to be executed only between the bank accounts of the borrower and the regulated entity without any pass-through or pool account of the lending service provider (LSP) or any third party.

As per the new norms released by the RBI, all loan disbursals and repayments will have to be executed only between the bank accounts of the borrower and the regulated entity without any pass-through or pool account of the lending service provider (LSP) or any third party.

Also Read | Bihar: Nitish Kumar takes oath as CM for 8th time; Tejashwi Yadav as his deputy

Only entities regulated by RBI, other bodies permitted by law can carry out digital lending, added the RBI.

The Reserve Bank's regulatory framework is focused on the digital lending ecosystem of RBI's Regulated Entities (REs) and the Lending Service Providers (LSPs) engaged by them to extend various permissible credit facilitation services.

With regard to entities authorised to carry out lending as per other statutory/regulatory provisions, but not regulated by RBI, the respective regulator/ controlling authority may consider formulating or enacting appropriate rules/regulations on digital lending based on the recommendations of WGDL.

Also Read | Bihar: Nitish Kumar takes oath as CM for 8th time; Tejashwi Yadav as his deputy

Only entities regulated by RBI, other bodies permitted by law can carry out digital lending, added the RBI.

The Reserve Bank's regulatory framework is focused on the digital lending ecosystem of RBI's Regulated Entities (REs) and the Lending Service Providers (LSPs) engaged by them to extend various permissible credit facilitation services.

With regard to entities authorised to carry out lending as per other statutory/regulatory provisions, but not regulated by RBI, the respective regulator/ controlling authority may consider formulating or enacting appropriate rules/regulations on digital lending based on the recommendations of WGDL.

Also Read | HC orders status quo in Mohali panchayat land grabbing case

For the entities lending outside the purview of any statutory/ regulatory provisions, the WGDL has suggested specific legislative and institutional interventions for consideration by the Centre to curb the illegitimate lending activity being carried out by such entities.

The RBI is statutorily mandated to operate the credit system of the country to its advantage. In this endeavour, it has encouraged innovation in the financial system, products and credit delivery methods while ensuring their orderly growth, preserving financing stability and ensuring protection of depositors' and customers' interest.

Recently, innovative methods of designing and delivery of credit products and their servicing through digital Lending route have acquired prominence. However, certain concerns have also emerged which, if not mitigated, may erode the confidence of members of public in the digital lending ecosystem.

Also Read | HC orders status quo in Mohali panchayat land grabbing case

For the entities lending outside the purview of any statutory/ regulatory provisions, the WGDL has suggested specific legislative and institutional interventions for consideration by the Centre to curb the illegitimate lending activity being carried out by such entities.

The RBI is statutorily mandated to operate the credit system of the country to its advantage. In this endeavour, it has encouraged innovation in the financial system, products and credit delivery methods while ensuring their orderly growth, preserving financing stability and ensuring protection of depositors' and customers' interest.

Recently, innovative methods of designing and delivery of credit products and their servicing through digital Lending route have acquired prominence. However, certain concerns have also emerged which, if not mitigated, may erode the confidence of members of public in the digital lending ecosystem.

The concerns primarily relate to unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices.

On the data privacy front, the RBI has said the data collected by digital lending apps (DLAs) has to be need based, should have clear audit trails and be only done with prior explicit consent of the borrower. Further, these apps have to provide an option to borrowers to accept or deny consent for use of specific data.

-PTC With ANI inputs

The concerns primarily relate to unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices.

On the data privacy front, the RBI has said the data collected by digital lending apps (DLAs) has to be need based, should have clear audit trails and be only done with prior explicit consent of the borrower. Further, these apps have to provide an option to borrowers to accept or deny consent for use of specific data.

-PTC With ANI inputs