Relief for borrowers as RBI decides to keep repo rate unchanged at 6.5 pc

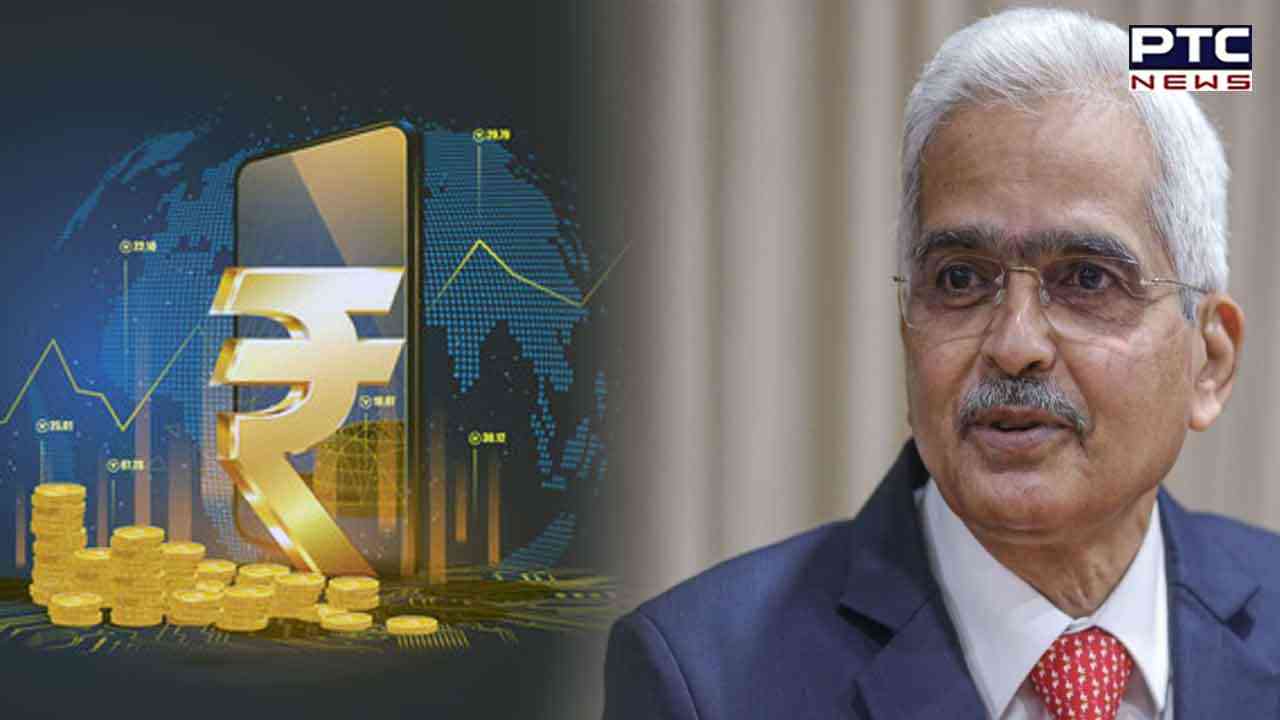

New Delhi, April 6: The Reserve Bank of India on Thursday has decided to keep the key benchmark interest rate - repo rate - unchanged at 6.5 per cent. RBI decided to maintain the key benchmark interest rate at 6.5 per cent, after a two-day monetary policy (MPC) meeting, Governor Shaktikanta Das announced.

RBI Governor Shaktikanta Das said on Thursday that five out of six members of MPC voted in the meeting to remain focused on the withdrawal of the accommodation to ensure inflation aligns while focusing on the growth. The RBI Governor further said the central bank's policy stance remains focused on "withdrawal of accommodation", signalling it could consider further rate hikes if necessary. The pause in rate hikes is "for this meeting only", Shaktikanta Das said.

Also Read: Temple vandalised in Ontario: Police seek suspects in hate-motivated vandalism at Windsor temple

According to information, the repo rate hike has been paused after six consecutive rate increases aggregating to 250 basis points since May 2022. As per, Reserve Bank of India, has decided that the standing deposit facility (SDF) will remain unchanged at 6.25 per cent and the marginal standing facility (MSF) and bank rates unchanged at 6.75 per cent.

RBI Governor Shaktikanta Das-headed Monetary Policy Committee (MPC) which conducted its three-day meeting from April 3, 5 and 6 amid the rate hiking spree that started in May last year to check inflation.

During the last MPC meeting of RBI in February, it was decided to raise the repo rate by 25 basic points to 6.5 per cent to manage inflation. Till now RBI raised the repo rate, the rate at which it lends to banks, by 250 basis points cumulatively since May 2022.

Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Inflation had been staying above the RBI's tolerance limit of 6 per cent for two consecutive months since January. In February, India's retail inflation stood at 6.44 per cent, while in January, it was at 6.52 per cent.

- ANI