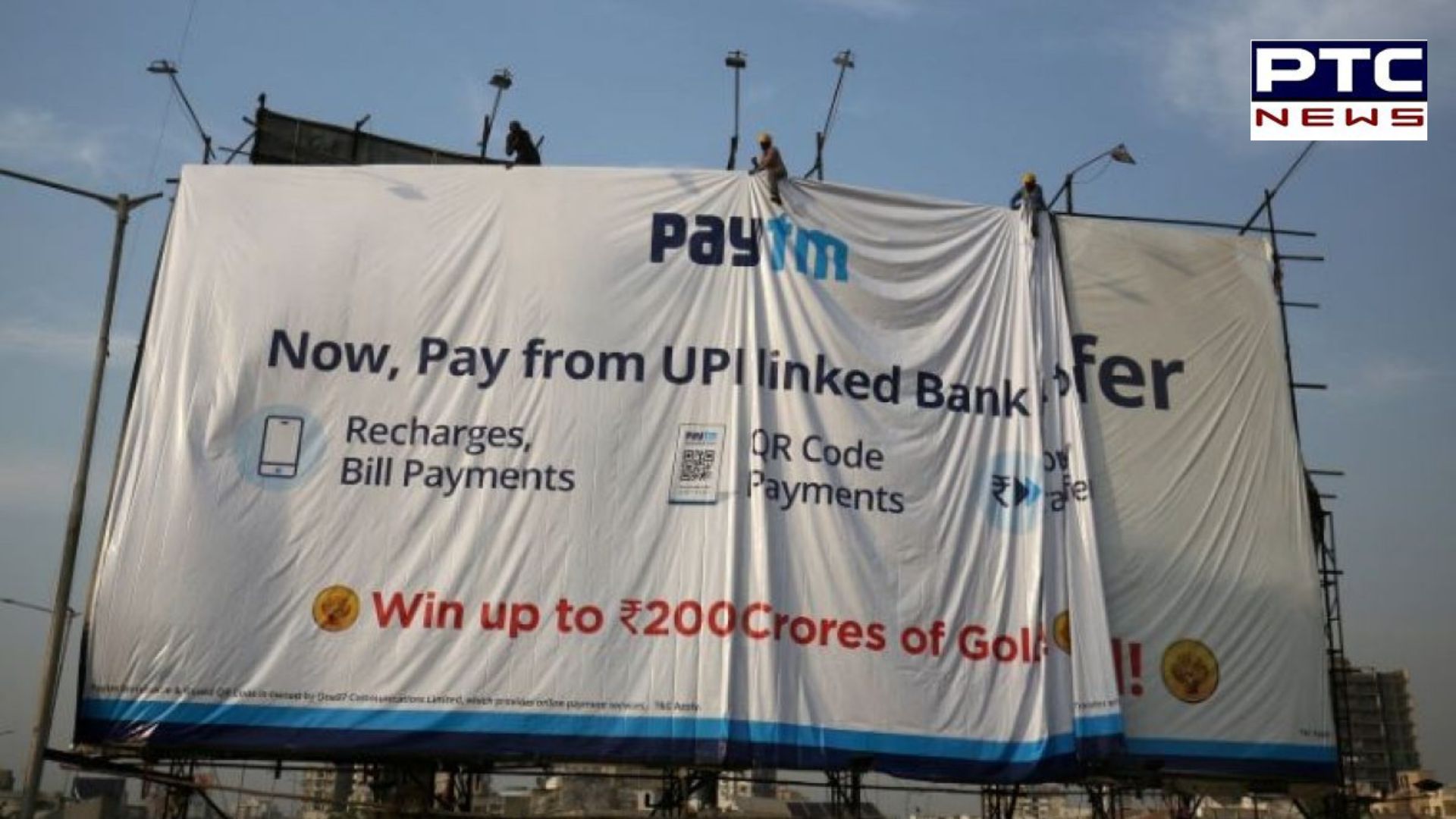

PTC News Desk: The share price of Paytm has witnessed a significant surge, marking a 10 per cent gain over the past two days. Notably, in the latest trading session, Paytm shares closed at Rs 341.30 on the NSE, registering a 5 per cent increase and hitting the upper circuit.

The upward momentum in Paytm's share price can be attributed to several factors, with one major development being its partnership with Axis Bank for the settlement of merchant payments. This strategic collaboration comes at a crucial time for the crisis-hit company, bolstering investor confidence.

As of 9:16 am today, Paytm shares continued their bullish trend, gaining 5 per cent and reaching Rs 358.35 on the NSE. The consecutive sessions of hitting the upper circuit reflect growing optimism among investors regarding the company's future prospects.

/ptc-news/media/media_files/paytm 1.jpg)

A notable decision contributing to this positive sentiment is Paytm's parent company, One97 Communications, shifting its nodal account to Axis Bank through an escrow account. This move not only enhances operational efficiency but also underscores the company's commitment to ensuring seamless services for its merchant partners.

Also Read: Kisan Andolan 2.0 | What is Govt’s 5-year-plan to buy crops at MSP; farmers’ next step?

Also Read: Farmers' Protest Live Updates Day 7 LIVE: 'Delhi chalo' march on hold after fourth round of talks

Despite facing a downturn in recent months, with the stock witnessing a 55 per cent decline over the past month, Paytm's strategic initiatives, such as the partnership with Axis Bank, are evidently resonating well with investors. As the company continues to navigate challenges and explore growth opportunities, the recent surge in its share price reflects renewed investor confidence in Paytm's resilience and future prospects.

RBI extends deadline for Paytm Payments Bank: Key Updates

The Reserve Bank of India (RBI) has announced an extension of the deadline for the cessation of operations and the transfer of assets for Paytm Payments Bank account holders. The new deadline has been extended until March 15, allowing account holders additional time to manage their assets.

In addition to the deadline extension, the RBI has also released a comprehensive list of frequently asked questions (FAQs) aimed at providing clarity to Paytm Payments Bank account holders. These FAQs address various concerns, including inquiries related to remaining balance, UPI payments, and FASTags.

The RBI's directive stipulates, "No further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, National Common Mobility Cards, etc. after March 15, 2024 (extended from the earlier stipulated timeline of February 29, 2024), other than any interest, cashbacks, sweep in from partner banks or refunds which may be credited anytime."

This extension provides Paytm Payments Bank customers with a grace period to make necessary arrangements and transitions in alignment with the regulatory requirements set forth by the RBI. It emphasizes the importance of compliance and adherence to regulatory guidelines within the banking sector.

Also Read: Punjab: Gangster Kala Dhanaula shot dead, 2 cops injured in Barnala’s encounter

Also Read: Delhi excise policy case: Delhi CM Arvind Kejriwal to skip sixth ED summon today, says AAP

(Inputs from agencies)